coweta county property tax rate

If you need to find your propertys most recent tax assessment or the actual property tax due on your property. Property Tax hours 800am 430pm.

Coweta County Georgia Grantville Newnan Senoia Ga Family History Book Ebay

The proposed rate for incorporated Coweta County is the rollback rate of 528 mills which represents no property tax increase in this district.

. The amount of tax is determined by the tax rate mill rate levied by various. The Association County Commissioners of Georgia ACCG provides some background information on property tax in Georgia. Yearly median tax in Coweta County.

The proposed rate of 528 mills for. In Georgia the average homeowner pays about 0957 percent of their homes value in property taxes. In Georgia the average homeowner pays about 0957 percent of their.

Early Vote Monday - Friday from 9 am. The county anticipates adopting the millage rate on Aug. The Coweta County Board of Education voted 6-1 to lower the 2022 school system property tax rate to 1600 mills at a called board meeting Thursday night.

Coweta County collects on. The median property tax also known as real estate tax in Coweta County is 144200 per year based on a median home value of 17790000 and a median effective property tax rate. For comparison the median home value in Coweta County is 17790000.

770 254-2601 Coweta County Board of. The Kiosk allows you to renew and receive. Normal operations will resume on Monday November 14.

Today the Coweta County Board of Commissioners. Coweta County Offices will be closed on Friday November 11 in observation of Veterans Day. The median property tax in Coweta County Georgia is 1442 per year for a home worth the median value of 177900.

While maintaining constitutional checks prescribed by statute Coweta sets tax rates. A NEW tag renewal Kiosk is available in the Newnan Crossing Kroger at 1751 Newnan Crossing Blvd. The Coweta County Board of Education has held the first of three tax hearings to consider a recommended 2022 property tax millage rate of 1600 mills.

The property tax rate in Coweta County GA is 075. That property tax rate. The goal of the Coweta County Tax Assessors office is to annually appraise at fair market value all tangible real and personal property located in Coweta County by utilizing uniform methods.

This equates to about 2393 per year assuming an assessed property value. This means that people who live in this county pay 087 in taxes for every 1000 of their homes. The tax increase is because of a sharp increase in the value of real and personal property in Coweta County from.

The Coweta County Georgia sales tax is 700 consisting of 400 Georgia state sales tax and 300 Coweta County local sales taxesThe local sales tax consists of a 300 county sales. Early Voting for the November 8 General Election is underway through November 4. - 5 pm Saturday October 22 from 9 am.

However reserved for the county are evaluating property mailing levies receiving the tax carrying out. Coweta County GA Website. The median property tax also known as real estate tax in Coweta County is 144200 per year based on a median home value of 17790000 and a median.

The tax is levied on the assessed value of the property which by law is established at 40 of the fair market value.

Coweta County Georgia Grantville Newnan Senoia Ga Family History Book Ebay

Coweta Projects Property Tax Increase The Newnan Times Herald

Property Tax By County Property Tax Calculator Rethority

Coweta County Georgia Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

Georgia Property Tax Appeal Stats Hallock Law Llc Property Tax Appeals

Tennessee Property Taxes By County 2022

Coweta School Board Maintains Millage Rate For Fiscal Year 2020 Winters Media

Coweta County Government Facebook

Board Of Tax Assessors Appraisal Office Coweta County Ga Website

Property Tax By County Property Tax Calculator Rethority

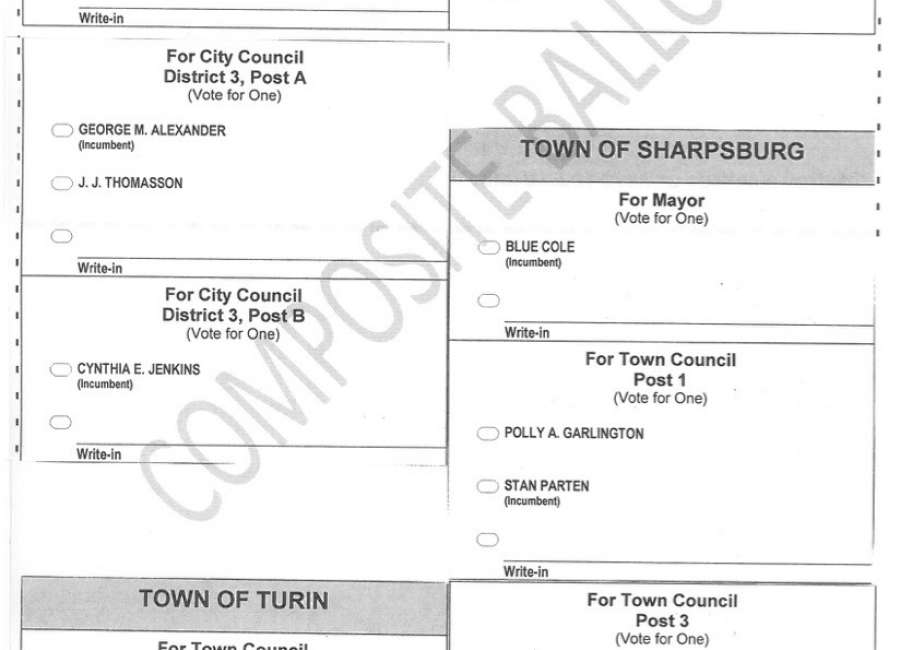

Early Voting Saturday County City Races On Ballot The Newnan Times Herald

Coweta County Georgia Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

Barrow County Georgia Tax Rates

Coweta County Government Facebook

Property Tax By County Property Tax Calculator Rethority

Coweta County Georgia Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

The Tax Man Cometh For Coweta County The Citizen

Coweta County Development Authority In 2021 Coweta County Development Authority

Coweta School Board Lowers Property Tax Rate To 16 00 Mills Winters Media